TL;DR

- The mobile device insurance market is growing, set to triple by 2032

- It’s difficult for MVNOs to open insurance enrollment year-round or with BYOD cases without proper visibility into a device’s condition

- MVNOs need tools to diagnose and assess a device objectively so they can comfortably increase insurance offers year-round

For MVNOs, device insurance can be more than just a value-added service to customers, but a real growth lever for operators. The mobile device insurance market in North America is on track to nearly triple by 2032, signaling demand and a strong opportunity for operators to boost ARPU.

In a survey of over 23,000 carrier customers, MCE found that one in four consumers needed a repair within just two years, with a cost that could reach as high as $300. That means a significant slice of operators’ customer bases are running into issues that device protection plans could cover. And depending on the plan, attaching device protection can lift ARPU by anywhere from $6 to $18 per user depending on the comprehensiveness of the coverage. The opportunity is there, but so are the barriers to opening it up.

The Catch: Limited Visibility into the Device

MVNOs face a unique challenge in growing insurance attachment: limited knowledge about the customer’s device. Unlike traditional operators that sell the handset as part of the package, MVNOs often deal with bring-your-own-device (BYOD) customers. That means no real visibility into the condition or risk profile of the phone, since it is foreign. Without this, it’s hard to determine eligibility or to make a precise insurance offer without exposing the business to unnecessary risk.

This leads to missed opportunities. Some customers might get blanket-denied coverage unfairly. Others might never even be offered a plan, especially if they joined through a BYOD.

High-Definition Visibility: App-Based Diagnostics

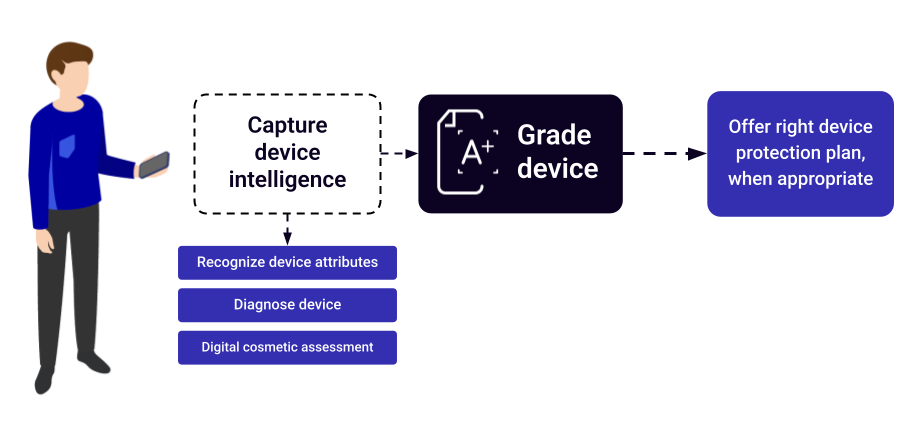

This is where on-device diagnostics come in. By building diagnostic capabilities into the central or standalone app, MVNOs can turn an unknown device into a well-known one in minutes. When a customer is prompted to or opts to run a quick diagnostic test, MVNOs get a digital, objective look at their device’s condition. No guesswork, no manual inspection.

With this in place, MVNOs can safely open up insurance enrollment, even outside the usual windows. Whether it’s a new customer onboarding with a BYOD device or an existing one browsing in the app, MVNOs can trigger insurance offers based on real-time diagnostics. That makes the offer smarter, reduces risk and gives customers the protection they want,when they want it.

For MVNOs looking to boost ARPU and make insurance a reliable revenue stream, on-device diagnostics turn a blind spot into a strategic advantage. Learn more about MCE’s solutions for offering device protection opportunistically.