TLD;DR

- Satellite has launched for consumers; devices need to be managed for the terrestrial-to-D2D transition in real-time | JUMP TO SECTION

- OEMs introduced AI to improve consumer experience; carriers will need to introduce AI tools into their apps to take back stake in customer mobile experience | JUMP TO SECTION

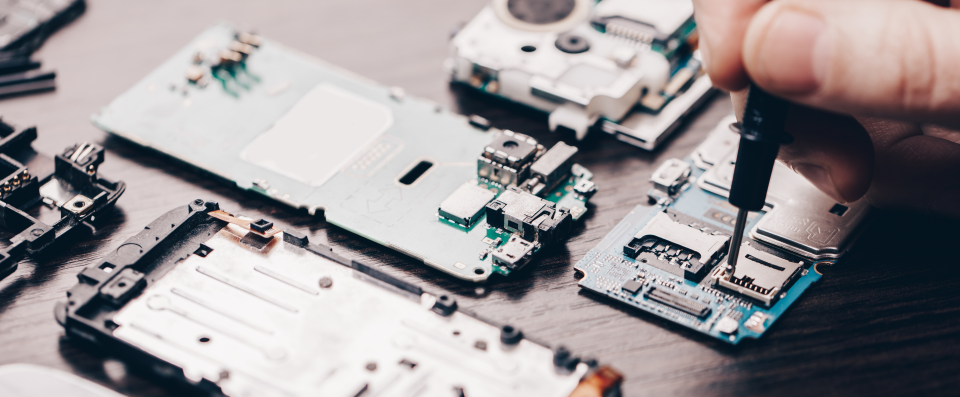

- EU legislation will demand that carriers in Europe offer reasonable repair options; carriers must re-explore how to generate revenue from this as trade-ins are often not financially feasible | JUMP TO SECTION

- Trade-ins are far from dead and they don’t have to be relegated to annual events; consumers will be more likely to trade-in now if trust in the device valuation method is there | JUMP TO SECTION

2025 saw the accelerated introduction of new network infrastructure, a device-level AI arms race, ramping up of repair rights and a growing trade-in market. All of these are all reshaping the rules for 2026 – and for operators, this requires a fundamental understanding of the mobile landscape shift. Below are the four stories every carrier should look at in retrospect to consider what they mean for the year ahead and why the mobile device is a crux of customer relationship with each one.

#1: D2D satellite coverage as a competitive catalyst

T-Mobile’s 2025 satellite push, which started from satellite messaging in July to expanded data in October, set a new standard for carriers. With 657 satellites operational and 1.8 million beta users signed up, T-Mobile’s first-mover position forces industry rivals to keep up. AT&T customers were reportedly already keen on this service via T-Mobile’s partnership. Other carriers like Vodafone – who showcased the first satellite video call in January – are also investing in satellite coverage work, signaling that hybrid satellite-terrestrial service will move from niche to mainstream. Now, mobile experience needs to be primed for it.

What to consider for 2026

Connectivity Transition. Mobile operators will need to treat hybrid satellite–terrestrial connectivity as also a device-dependent problem, not just an infrastructure one, and build the processes to guarantee satellite-readiness for customers traveling to or living in remote areas. This means ensuring devices have up-to-date modem firmware, intact antenna performance and sufficient battery health to handle satellite links, which drain battery faster. They should deploy real-time device diagnostics that flag at-risk handsets before customers enter dead zones and push timely interventions, which includes firmware updates or settings fixes. Device signals must feed into operational workflows for carriers to preempt failures, reduce support load and accelerate resolutions for network transition.

#2: The race to AI-driven mobile CX as the new battleground

Samsung’s push to bake AI into daily phone usage made on-device intelligence a headline differentiator in 2025 with its Galaxy AI technology and implementation of Google’s Gemini, and that trend accelerates into 2026 as more phones include powerful intelligence. On-device AI enables private, real-time experiences, ranging from translation to generative content to proactive assistance on personal and technical matters. For carriers, this changes the battleground from predominantly network specialization to device experience propositions that they can insert themselves into.

What to consider for 2026

OEMs will continue to develop their devices to meet consumer AI capability demands. By extension, this suggests OEMs will grab an increasingly bigger share of the traditional device-related service and experience of consumers. As on-device AI becomes ubiquitous, mobile operators risk forfeiting more ground to OEMs on the customer relationship around the device. Where mobile operators can gain both an edge over competitors and OEMs is introducing always-on AI into their apps – a tool to provide customers insights on device health and appropriate solutions or commercial offers when appropriate.

#3 EU Right to Repair: regulation reshapes the aftermarket

Businesses are preparing to comply with the EU’s 2024 ecodesign and repairability rules, which come into effect in July 2026. This marks a long-term regulatory shift: longer spare-part availability and extended software support will soon become standard in many markets. As the EU transposes “Right-to-Repair” into law and similar legislative moves spread, the aftermarket, this means repairs, certified refurbishment and the required transparent parts supply will become a strategic field rather than an afterthought. For mobile operators, smartphones take center stage.

What to consider for 2026

Mobile device experience positioning can ultimately give European operators a competitive advantage. The typical play with customers experiencing a device issue is to offer a trade-in or upgrade and renew the contract. However, trade-in and upgrade are often not financially feasible for customers with phone issues. Mobile operators will need to build alternative strategies to generate revenue or retention from repair. This requires thinking through customer experience as a mechanism toward retention, since needing a repair drops NPS by up to 60 points. First, is to offer customers clear repair options when trade-in or upgrade is not feasible and then manage the process end-to-end – provide repair solutions with upfront cost, give customers repair tracking visibility and make appointment booking easy.

#4 Trade-in market record: the circular economy rises

Q2 2025 set a milestone: $1.34 billion in trade-in value as device age climbed to nearly four years. Consumers are extracting more lifetime value from their devices, but they are still retaining substantial value due to improvement in device quality each year. With memory chip supply constraints driving up costs – a 30 percent increase expected for Q4 2025 and 20 percent in 2026 – consumers are expected to pay more for new devices. To offset the increasing costs, consumers will likely be more interested in trading in for their devices – if they can get a fair market, transparent value.

What to consider for 2026

Trade-in is neither dead nor does it have to be relegated to annual milestones – such as the new iPhone or Samsung device releases. Where consumers may have kept their older phones as backups when upgrading, they may now opt to trade them in. What prevents them from actioning trade-ins is trust. Successfully increasing trade-in conversions is contingent on exuding transparency and fairness in the trade-in process. In fact, nearly 50 percent of consumers experienced a change in appraisal after they executed a trade-in, increasing the balance on their bill. Customers must feel that the process of trading in outweighs the value of keeping their old phone as a backup. Here, mobile operators must introduce objectivity and convenience to the trade-in process to take full advantage of trade-in’s retention value.

MCE: Your mobile device strategy partner for 2026

MCE Systems, whose landed on The Fast Mode list of vendors to watch in 2026, enables mobile operators to manage customer mobile device experiences – from onboarding processes to troubleshooting issues to repair management to VAS upsell and then upgrade. By capturing diagnostic signals on the device, MCE introduces trust, objectivity and gives insights to mobile operators on their customers’ device disposition, which becomes actionable with AI. Device data acquisition – along with AI action – allows operators to better execute device-related strategies to retain customers, reduce cost to serve and identify new revenue generation streams, across channels of service. Explore MCE’s platform to see how our technology can help your organization’s device-related business objectives in 2026.