Increase Insurance Attachment with Lower Risk

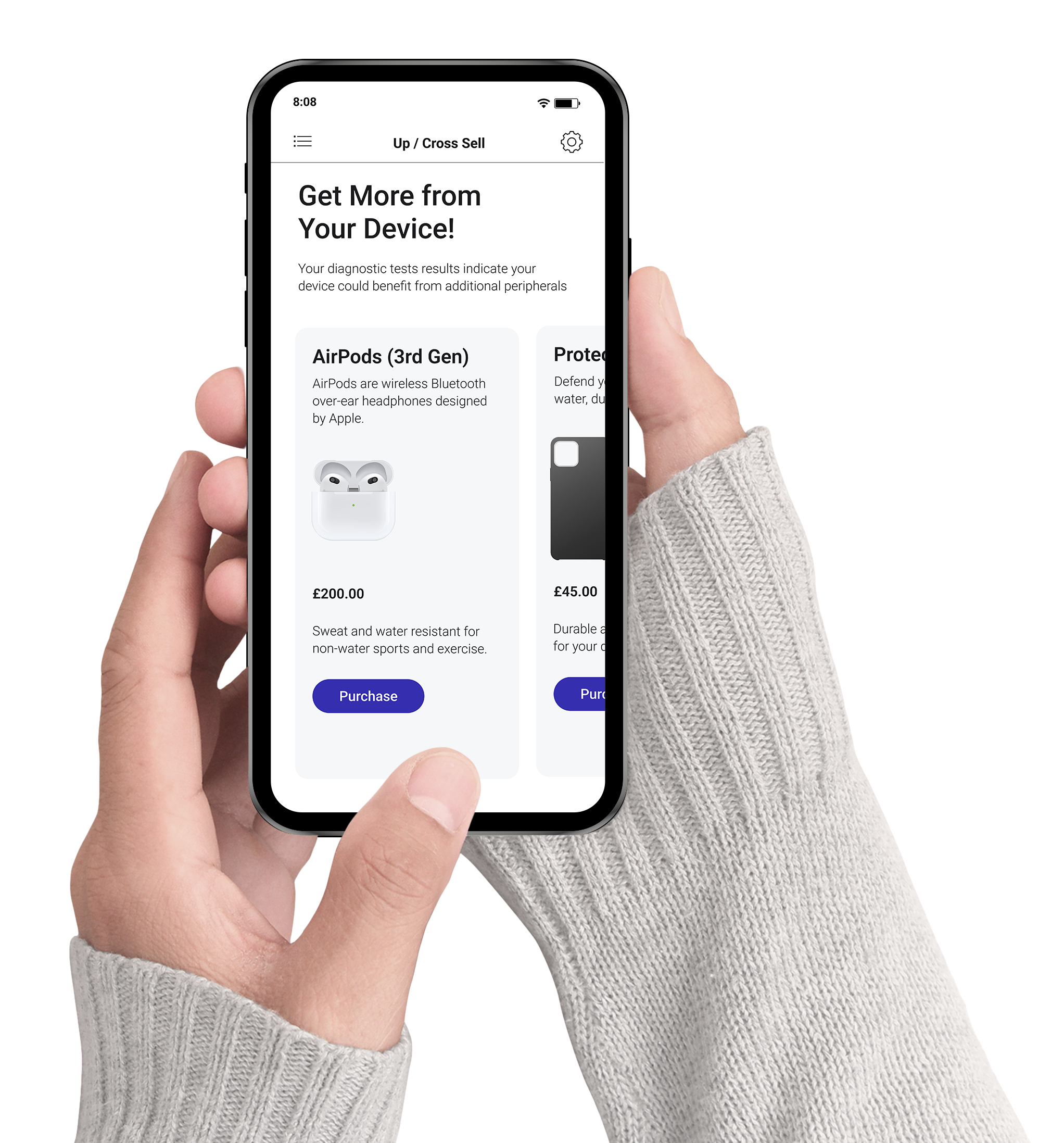

Open new opportunities to increase customer ARPU by upselling insurance plans by leveraging MCE’s digital device lifecycle management (dDLM) platform technology

Take Control of the Insurance Exchange with Robust Device Intelligence

Mobile operators are facing limited growth opportunities in a saturated market. Insurance is an effective revenue growth driver, but not knowing a device’s objective condition can create serious financial risk for an operator. What operators require is mobile device intelligence.

MCE’s digital-first platform captures robust intelligence, including diagnostics, configuration and cosmetic condition data to assess a device and customer disposition at any given point in the device lifecycle.

The diagnostics assessment results allow customers to validate their device’s condition for insurance enrollment, using in-store self-service tools, completing the process independently or with rep-supported assistance. This objective evaluation capability allows an operator to:

- Realize higher average selling price (ASP) thanks to cycle time optimization

- Save costs through leveraging pre-shipment information

- Make inoperable device sellable, unlocking untapped revenues

Boost open enrollment take rates by +20-30% via cosmetic grading

The MCE Difference: Omnichannel

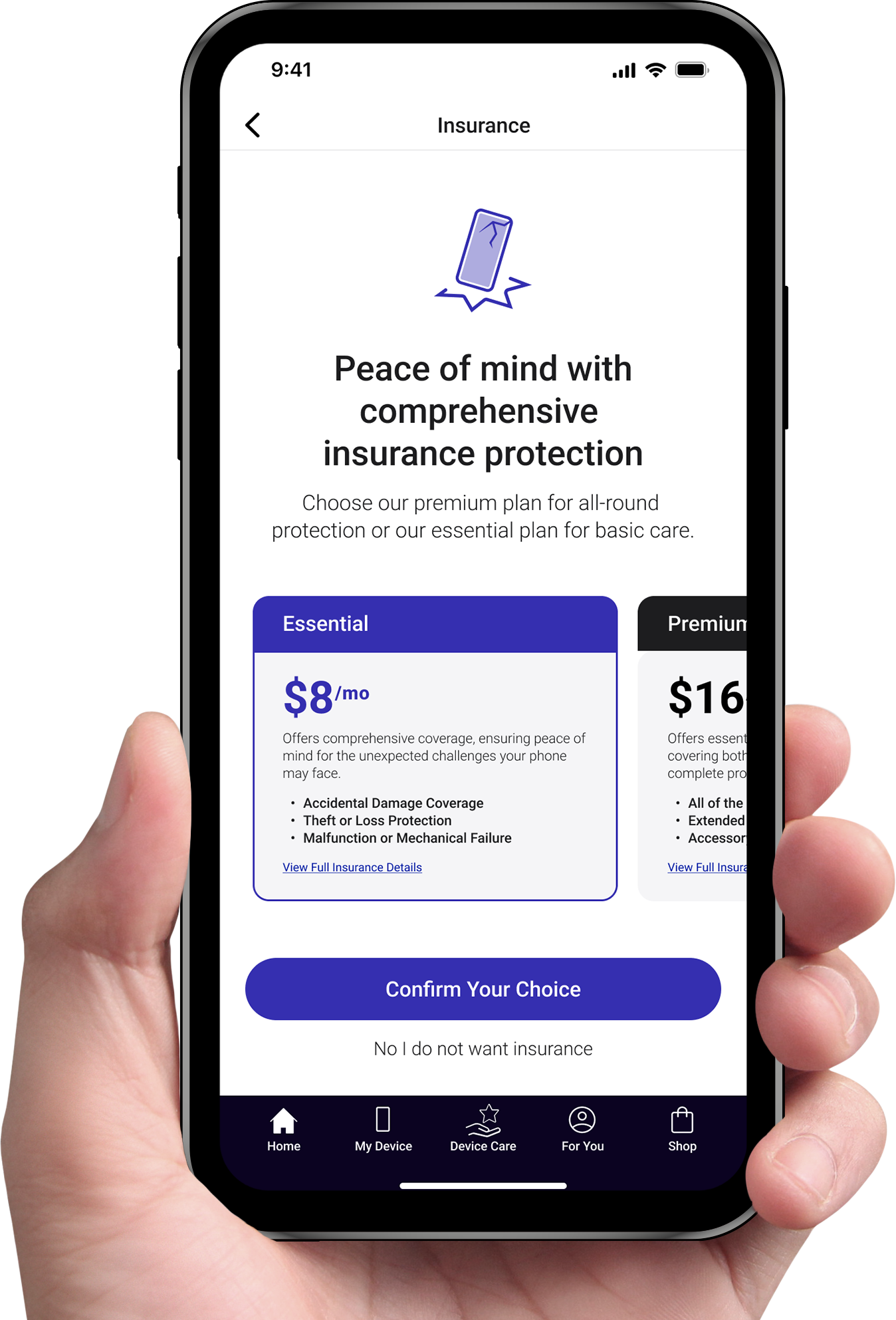

MCE delivers mobile operators omnichannel capability, allowing customers to purchase insurance on any channel, or start on one channel and complete on another. This capability is powered by MCE’s dDLM platform, which offers three core capabilities:

Remote intelligence

The ability to engage a customer remotely via themyOperatormobile app and service their needs, including the ability to assess insurance risk objectively in remote settings

Omnichannel flexibility

Providing the same standard of service and offers across any engagement channel, with the ability to offer insurance to customers in both retail and themyOperatorapp

Common data layer

Customer device history is leveraged towards a greater assessment of risk for insurance, while customer experience history helps connect journeys between channels to prevent repetition of steps

Know Your Customer: Bring-Your-Own-Device (BYOD)

Consumers are expected to keep their mobile devices longer as the price for a new one continues to rise. However, mobile operators trying to attach insurance to new customers with foreign devices face increased financial risk by not knowing their customer’s device. Operators can leverage MCE’s device intelligence capturing capabilities to take more control in the onboarding process, objectively assess a device’s condition and accurately evaluate insurance risk before attachment.

- Boost BYOD conversion by 40-65%-pts digital mix, & +40-60%-pts digital-first conversion.

Create New Revenue Opportunities:Year- Round Enrollment

Customers also prefer to receive contextual marketing promos, expressing higher satisfaction when they do (+6 NPS). Insurance is a powerful tool to both meet this expectation and help increase ARPU, yet it is relegated only to fixed periods during the year or device lifecycle.

MCE’s diagnostic technology allows mobile operators to attach insurance beyond traditionalenrollment periods with its device evaluation technology. This also allows operators to become proactive – encouraging customers to run device health checks on their device remotely and at timely points in the device lifecyclein order toidentify opportunities for contextual marketing, including insurance attachment.

Contextual Marketing Impact

Drive stronger customer retention with contextualized marketing on insurance attachment

Increase loyalty by +1-5bps with ongoing health checks and smart solution (i.e., upgrade vs. repair or selling insurance protection after showing clean device health)

Maximize re-attach post-churn

by +5-10% through contextual marketing

Leverage first 30-day eligibility with contextual marketing and cosmetic checks for +1-3%-pts attachment

Book a meeting